What To Do When The At-fault Vehicle Driver Does Not Have Enough Insurance Coverage

Exactly How Does Uninsured Vehicle Driver Protection Job?

- If legal action needs to be taken against the irresponsible motorist, seek advice from among the trusted auto accident attorneys in Maine at Hardy, Wolf & Downing.Accident targets that are instrumental can still go after an insurance claim against an irresponsible driver as long as the victim wasn't 50% or even more at fault.Understanding the subtleties of insurance protection and the legal needs associated with it is crucial for all motorists.Also if you have medical insurance, insurance coverage can be a much better option as you will not have to pay co-insurance, copays and health insurance deductibles.

If there's an accident in between 2 drivers, each party's PIP coverage normally pays for their corresponding clinical costs and/or wage loss up to their policies' limitations, regardless of who triggered the accident. In some cases, depending on the specific state's laws, the insurance companies from both sides might establish that there is shared blame for the crash, referred to as comparative mistake or shared obligation. If both sides are somehow deemed responsible for an accident, the state's oversight law will establish the amount of problems granted to every party for injury or property responsibility claims. For most individuals who remain in an accident, it is less complicated to resolve out of court for the limit of the responsible chauffeur's policy. If damages were substantial or the injured party has nothing else option, it isn't unusual to push for a settlement that goes beyond the policy limitations.

Recognize The Payout From An Underinsured Motorist Insurance Claim

They comprehend just how to value an insurance claim precisely to make sure that negotiations mirror the full extent of the client's losses. Finding out that the chauffeur in charge of your accident has no insurance coverage can leave you feeling defenseless. Also if you feel fine, it's smart to obtain had a look at by a medical professional after a mishap. Injuries from vehicle mishaps, like whiplash, could not be immediately noticeable. Here are examples of exactly how to make uninsured vehicle driver cases in different circumstances. You need to contend the very least a fundamental car insurance policy liability policy and after that include coverage to it.

Because situation, you can make an underinsured vehicle driver case against your very own insurance company as long as you have greater than $25,000 in underinsured protection. Under North Carolina legislation, the at-fault celebration is accountable for paying for injuries and damages. However if they do not have cars and truck insurance, there is no insurer to handle your insurance claim. You might have to https://pastelink.net/u3c0z9ok utilize your very own insurer or explore various other choices. Submitting a third-party case with the at-fault vehicle driver's insurance firm is the typical technique, however insurer usually inspect insurance claims extra very closely when the claimant does not have coverage.

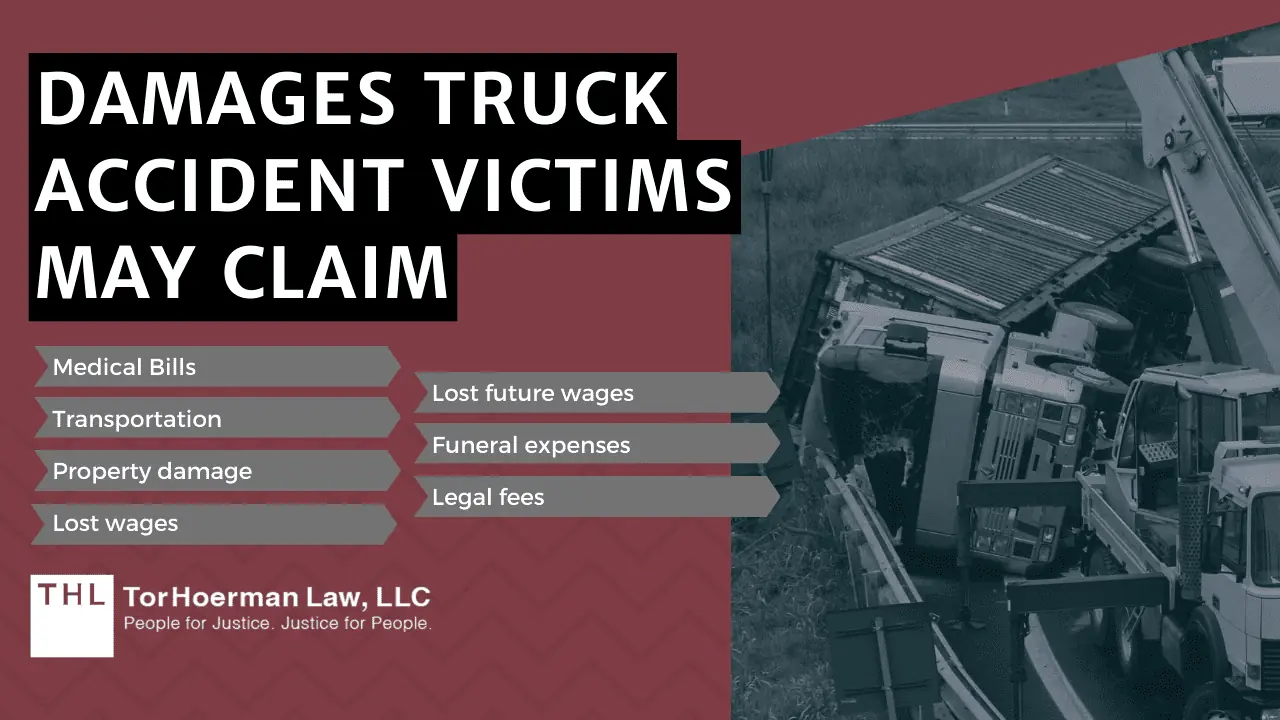

But, there are methods to get payment for your insurance policy cases, personal injury lawsuits, and home damages legal actions. Furthermore, injury security (PIP) can cover clinical expenses and lost incomes no matter who is at mistake. Call your insurer to file the case and supply all necessary documentation, consisting of the authorities record and medical records. Having a New York vehicle mishap lawyer in your corner can assist browse the intricacies of the insurance claim procedure and make certain that you maximize the repayment from your plan. When an uninsured vehicle driver triggers an accident, they are personally responsible for the damages.